Last year saw most plans, projects and even everyday activities put on hold.

Sadly, where our most-favoured parts of society were shut down, its less welcome facets continued to operate.

A rise in online shopping and banking, remote working and the general overwhelm of HMRC’s services led to an increase in many types of fraud in 2020.

A VAT ‘reverse charge’ designed to combat VAT fraud in the building and construction sector was due to be introduced in October 2020.

Although the government remains committed to tackling fraud of all kinds, its commitment to supporting businesses throughout the pandemic took priority as the new rules were further delayed until March 2021.

The reverse charge was pushed back to allow businesses to focus on enduring the impacts of the pandemic.

But, with March 2021 around the corner and no sign of the new rules being delayed again in sight, here’s what your business needs to know about the new VAT rules within the construction and building industry.

The VAT reverse charge

The domestic ‘reverse charge’ is a measure that has already been introduced for other services. The system shifts the liability for accounting for output VAT from the supplier to the customer.

This prevents the supplier from charging what appears to be VAT and then not paying this element over to HMRC.

A customer of construction-based services within the industry will have to pay the VAT directly to HMRC rather than paying it to the supplier before recovering this amount on the same VAT return.

Who the new rules affect

The new reverse charge rules will only affect supplies at standard or reduced rates where payments are required to be reported through the CIS.

The CIS is a program which deducts advance payments for subcontractor’s tax and National Insurance liability when they are paid by contractors for work relating to construction.

Construction operations defined in CIS include construction, alteration, repair, extension, demolition, painting and decoration. The services of architects, surveyors and certain consultants are excluded.

How this affects you

The reverse charge was first due to come into effect in October 2019, but this was delayed as the government felt that not enough businesses were prepared.

Though it serves a noble cause, the reverse charge will have a significant impact on the VAT and cash flow management of businesses affected, requiring fundamental changes to the way they keep their books.

New processes will need to be introduced or current processes amended in order for businesses to keep up with their new VAT commitments.

Smaller sub-contractors often rely on the positive cashflow provided by payments including a VAT element, which will now disappear where the reverse charge applies.

In order to prevent disruption to supply chains and protect small sub-contractors, contractors may want to ensure that their sub-contractors are prepared for the reverse charge or are made aware that the new rules apply to their services.

It is vital that businesses are prepared for the new rules or penalties may be imposed.

In the guidance for the new rules, HMRC states that it will “apply a light touch in dealing with related errors that occur in the first six months of the new legislation, as long as you are trying to comply…and have acted in good faith”.

If you sell building and construction services

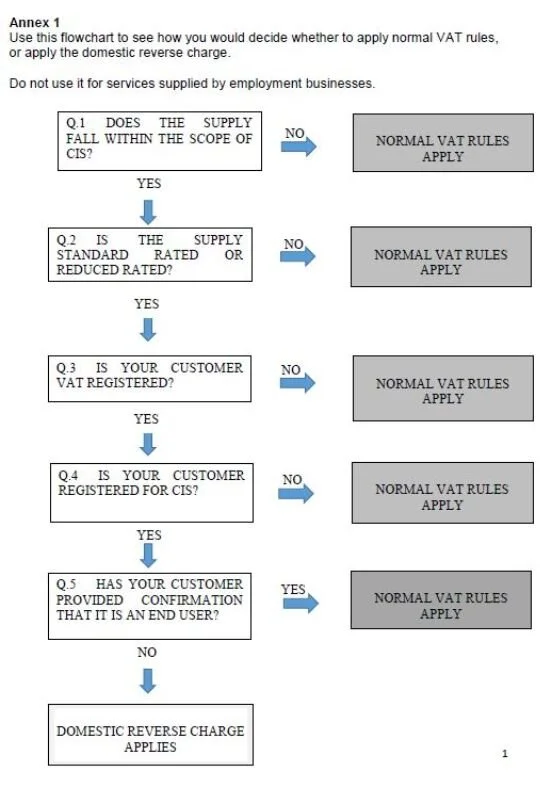

The below flowchart from HMRC will help you decide if you need to use the reverse charge.

The reverse charge will need to be used when:

your customer is registered for VAT in the UK

payment for the supply is reported within the Construction Industry Scheme (CIS)

the services you supply are standard or reduced rated

you’re not an employment business supplying either staff or workers, or both

your customer has not given written confirmation that they’re an end user or intermediary supplier

If you buy building and construction services

The below flowchart from HMRC will help you decide if you need to use the reverse charge.

The reverse charge will need to be used when:

payment for the supply is reported within the Construction Industry Scheme (CIS)

the supply is standard or reduced rated

are not hiring either staff or workers, or both

you’re not using the end user or intermediary exclusions

How can we help you?

In such testing times, the last thing you need is a VAT-induced headache. KBL are on hand to assist you and your finances in any way should you be affected by the new VAT reverse charge.